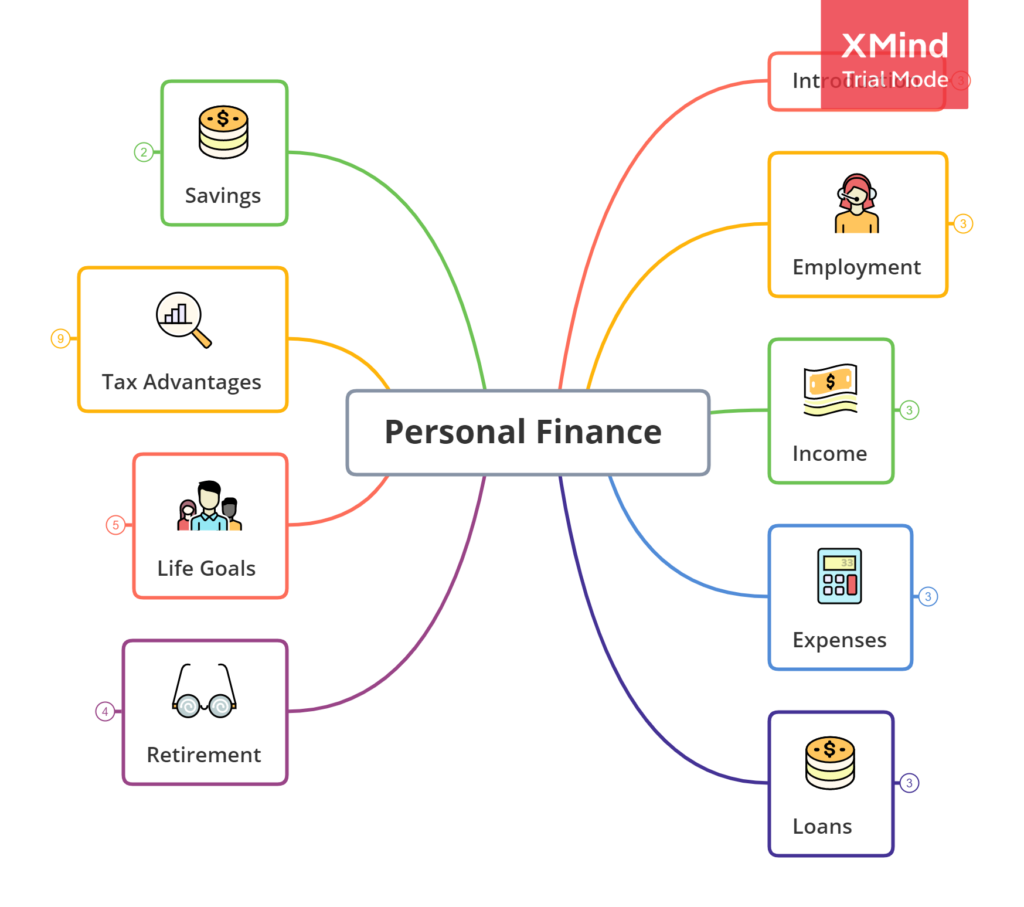

Personal Finance

Hi friends, Nitesh Ghodichor here.

As a Financial Advisor, I appeal to everyone to think about personal finance. It is a very much needed thing for you and your family.

I am going to discuss some good questions here with a close friend.

Let us start with a generic question.

Nitesh, How to manage personal finance?

I am still confused because at the end of the month a negligible amount is balanced in the salary account.

Please Explain.

Yes, why not? It is my pleasure.

Money is not everything, but everything requires money.

You try to understand the above quotes first to learn how to use them properly or manage them.

This article is helpful to all readers, who are in a job, freelancer, startup, retail businessmen, younger people, women, close to retirement and dreaming about a better tomorrow or want to become rich or achieve their financial goals.

As I know, you are a working person and one earning resource at your home. It does not matter if you are in a Private firm or any public sector or self employee. You need to learn personal finance management.

Lots of resources available on the internet, But you should pick up a good and better term mentor to learn and apply it to managed investments.

Income

This term you can consider it as your fixed monthly salary or earning from your business. If you are married or not married as per your income and expenses, now calculate your need in the future for service or achieve financial goals.

Expenses

It depends on your lifestyle, how much you are spending on you to manage your lifestyle.

Do you have a car or house or any liabilities? If yes, then it will show how much freedom you have the freedom to do any savings or investments. Otherwise, you are free from any unwanted liabilities, then you can use your freedom towards saving and investing.

Liabilities like a car, an expensive house, an unwanted thing which is not helping us grow financially.

Beware of Little Expenses, a small leak will sink a great ship.

– Benjamin Franklin.

Loan

If you are avail loan facility. It is good for something, not for everything. Friends, just imagine while applying for any loan executive ask for your income proof like a salary certificate. it should be less than the last three months. They calculate our capability or capacity to repay the loan, people cannot understand while calculating your eligibility for such loan require amount consider your monthly expenses then they offer you some amount.

Loan companies taking care of you and your monthly income, you lose that point.

Repayment of loan taking a long duration.

Quick to borrow is Always slow to pay.

Whatever loan you have, Repay it as early as possible and feel free from it.

Feel the freedom to use your money to achieve your financial goals. Read some Personal Finance Books.

Saving

We have discussed income, expenses, and loans.

Saving is an important term or habit in life. Which will make you happy and healthy financially.

Save Money And It Will Save You

Save money has a lot of options, wherever you want to invest and earn money from it. Before starting it, you read the Objective of Investment.

Traditional investment tools are there you can use like, Banking investment, Fixed Deposit, RD, National savings scheme, and many more. (Read More on investing in Gold)

Smart investments because you have to beat the inflation you need more rate of interest on your investments.

You should be aware of investment tools, join any course to learn them. If my blogs are capable of explaining to you the investment term. I will be happy to start a free Personal Finance Course for my readers and everyone.

Savings terms related to your objective of investments also like Tax Advantages, Life Goals, and Retirement Plan.

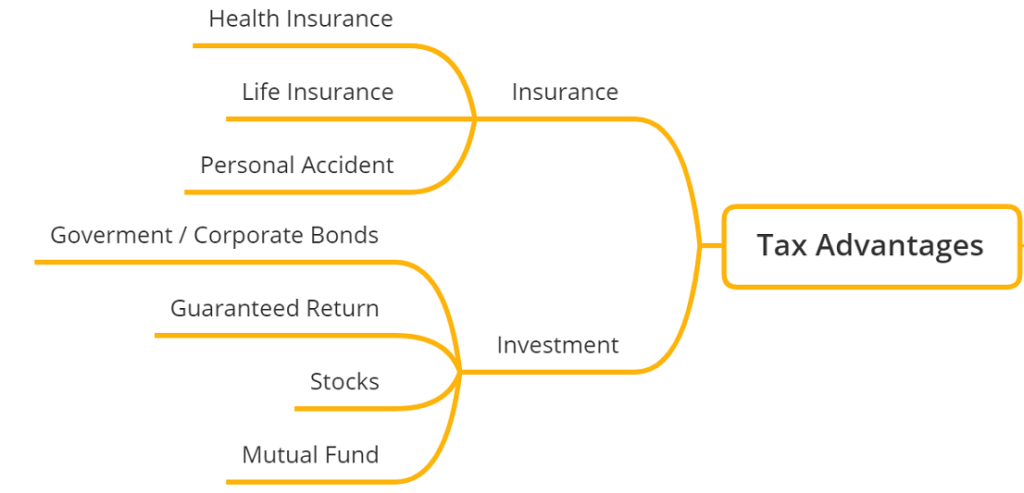

Tax Advantages

As you are an Indian citizen, you will be part of the taxpayer as per your income. Almost everyone wants to save tax or is misled by someone to save tax, or sometimes personal decisions to save tax also become a problem for us.

You do not consider the problem or mislead yourself to invest your hard-earned money in any instrument to save tax. Tax saving facility for you and you can avail this facility with earned money also save tax. (Read about What is Money?)

Tax Advantages give you a way to save tax with a good option. Understand first your requirement, try to understand the difference between Saving, Investment, and Insurance.

Every tax-saving instrument has a lock-in period, which means you can not redeem your investments or save in such an instrument as per respective schemes.

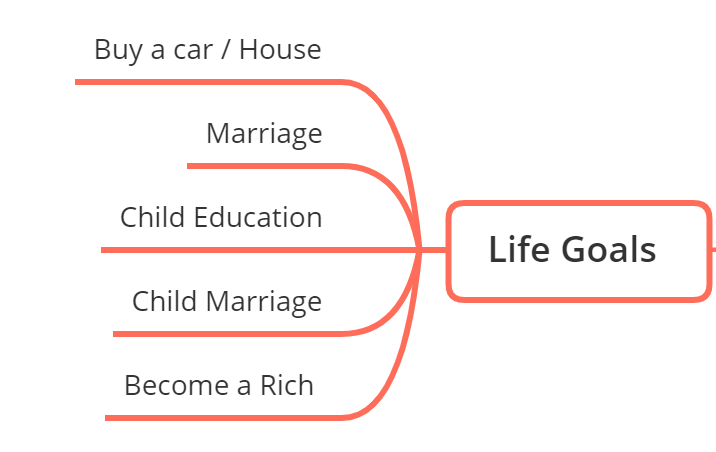

Life Goals

If you read my previous blog on “Objectives of Investments” then you will clarify why saving is a necessity of life.

Everyone wishes to have a good and happy life, but it depends on how to plan your life with different objectives.

Different Life Goals have to plan to achieve one by one and enjoy a happy moment throughout life.

You have to plan your life goals like

- Buy a Car

- Buy a Home

- Child Education and Marriage

- International Tour

- Long vacation

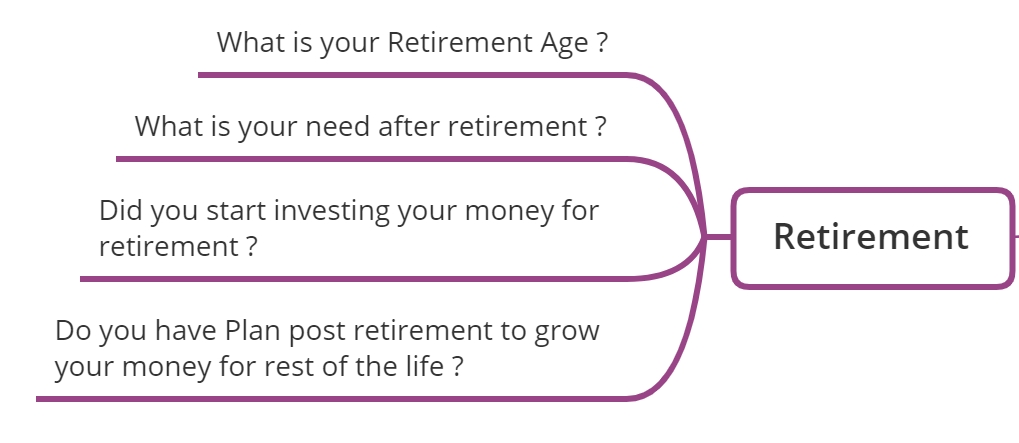

Retirement

Life goals there is one more step, it will happen in the life you have to think about your post-retirement life, how will you want to live and enjoy your relaxed life ahead.

You might start at a young age, the horizon of life leads you to opt for some savings from your income. Otherwise, you have to save forcefully more lumpsum amounts every year. It does not allow you the freedom to do like your choice because most of the income turns into savings or child expenses.

Retirement Is Not The End Of The Road. It Is the Beginning of the Open Highway

Because there is no restriction, Age is not a barrier to do anything like you can be an entrepreneur, join a startup, shop owner, and enjoy a world tour. Second inning life can be lived with your plan and choices. You have to plan your retirement with a life goal, post-retirement you will be physically and financially healthy.

You can handle your first income properly means in a few years you become a good personal finance manager. If you are confused then do not discourage yourself, ask someone about it any know financial advisor or RM.

Your Personal Finance is so easy to handle but you want to learn the terms of investments through an article. If not possible, then join any Personal Finance Management course, or you can do a mastery course. You are interested to learn more by starting more reading related to Personal Finance Books.

In this article, you and I discuss the meaning of personal finance and how to manage it. Relation between income and expenses to balance well. Loans impact on personal finance, repayment as early as possible. Save money and it will save you, start now. Tax saving options can be used for saving and earning, Tax advantages. You must be loyal to your country for development. The objective of Investments leads to planning your life goal and discipline to achieve it one by one. Every working employee can think about retirement age, the second inning can have more life goals with the same enthusiasm. Money isn’t everything, but everything requires money. Think saving, investment, and personal finance. You can learn it by joining any course or by reading books and consult with your financial advisor.

I hope this article helps you!

If you have any questions, you can comment on the article.

Recent Comments