Objective of Investment

Are you an investor? If yes or no doesn’t matter.

Do you know about the objective of investment? Let’s start now…

Nowadays there are a lot of resources available for investment awareness and courses but if you get confidence in investing in something with your own decision, I think a lot of readers will agree with me because investment is not a joke or game.

If we are aware about something then we are able to prevent and protect ourselves from any kind of incidents or problems which will be faced in future by you or your family.

As an investor, investing money or time under the guidance or advisor is good and better than earning more profit instead of creating wealth in discipline.

Using a lot of investment resources and investing your hard earned money without knowing the facts of investment, it will be dangerous for such an investor.

Objectives are important because, you cannot survive a life, you cannot do any task, it may be official or personal then how we can do the investment in something without objective.

This article is very helpful for all of you. Those are young investors, startup people, retail business men, and those people took their first salary, just joining a good company for a better future.

I am going to explain to you the objective of investment for you and your family.

Let’s start with some commitment and responsibility.

Define investment as per Oxford dictionary The act of investing money in something to encourage foreign investment.

Every person may have different objectives, and it depends on investment perspective only. There are following objectives you should know, these are safety, Income, capital growth, risk, tax Planning, retirement and financial goals.

Safety

Investment should provide safety, trust and integrity but it is not possible because if you want to earn some income from investment in something there will be risk.

Instead of investment, saving in some banks may become default. Consider any tangible investment like real estate risk also there with risk associated like property valuation, it will be destroyed due to natural calamity and acquired by government due to their any project.

Risk optimized by you and some sources then risk transfer of that property to insure it and pay some premium every year.

In comparison of investment and saving risk associated with all.

You need to choose such an investment tool where your investment and savings are secure and safe.

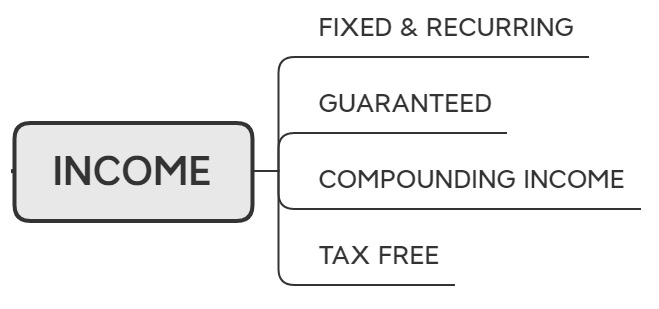

Income

The money you receive regularly as payment for your work or as interest on money you have saved, etc. or Income is the consumption and saving opportunity gained by an entity within a specified timeframe.

Income can come regularly from your everyday activity, from salary, from work. But some income comes from passive sources other than regular work like small business, part time services, entrepreneurs and start-up as any business.

You can earn your income from regular or other sources.

It may be fixed income, you can save and invest money in banks or any beneficial plan which will generate a less return on your capital.

Guaranteed Income, you can invest or pay premium for some particular period of year and it will generate income for you guaranteed commitment at time of day one.

Tax free income, you can generate income through such investment tools which is not application tax on income.

Compounding income, you can invest your money in some investment tools which can generate income in multiple return like stock market related tools, partnership in business, mutual fund and many more.

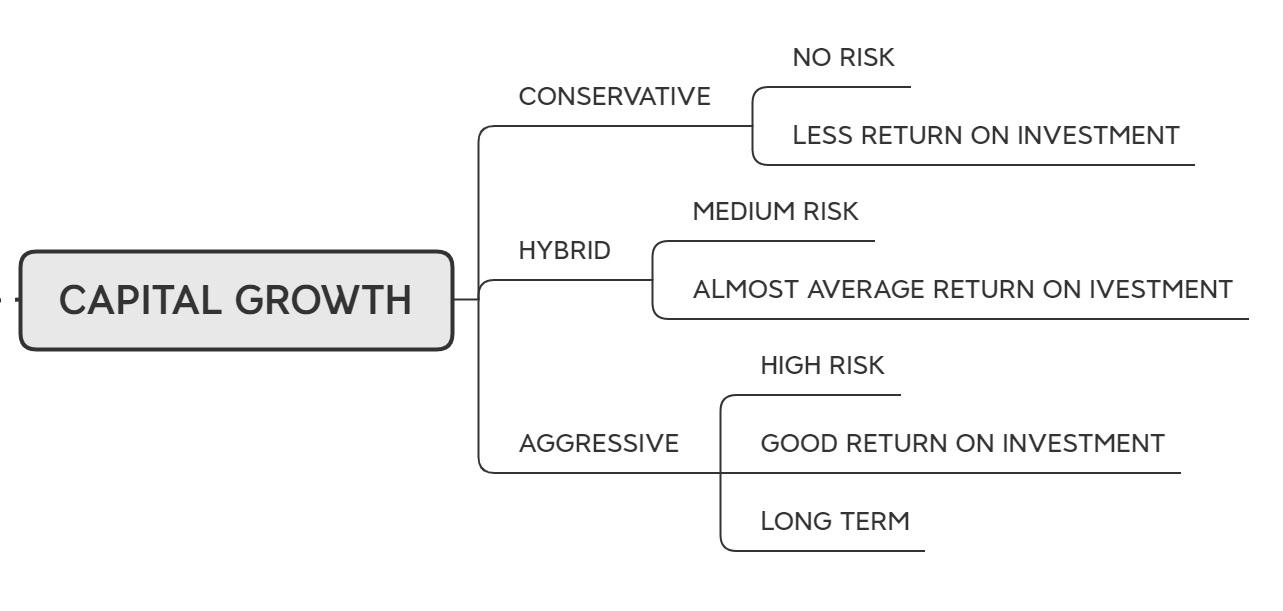

Capital Growth

In economics, capital consists of human-created assets that can enhance one’s power to perform economically useful work. (Source: Wikipedia)

Capital for you if you have invested money in different tools, your fund value or asset is a capital. It would be growth day by day or year by year again it depends upon investment perspective.

If you are an investor and you have bear risk capacity, then you can choose an investment like…

Conservative Investment with low risk and your capital will grow slowly with minimum return but you cannot beat the inflation no risk investment, capital growth slow but safe investment.

Hybrid investment with moderate risk and capital will grow more than conservative investment like average return on investment, here follow some ratio of investment.

Aggressive investment with high risk and capital will grow in multiple fold return on investment, capital growth in higher risk than previous two investment.

Aggressiveness in investment, you may get positive and negative return on investment but you should be long duration invested definitely you will have good capital growth. Short term duration is away from such aggressive investment.

Tax Planning

You can think it is an objective of investment, forcefully you will start investing to save money and big surprises for your future but there are a lot of tax saving tools. Prepare your tax planning with beneficial tools objective of tax planning only for claim exemption from 80C and 80D type of clause. While investing take care of investment tools available which can be accessible whenever we require in an emergency. Some tools are like NSc, PPF, ULIP, Senior citizen scheme, insurance and their benefit plan and ELSS.

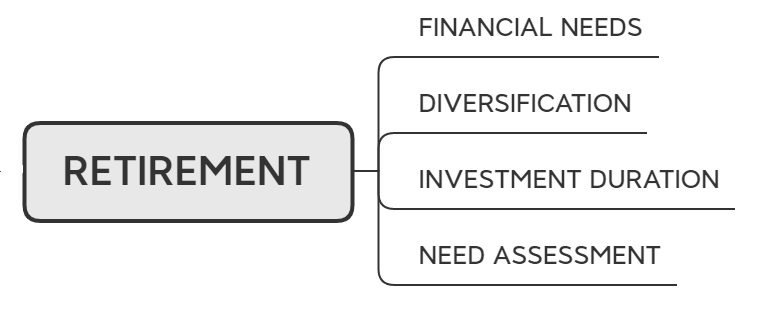

Retirement Planning

Retirement should be your first and last objective to protect and secure the future need to survive your life with family or individually.

If you are young, you can have the capacity and capability to bear risk because you will get regular income from salary or your own business. And at the age of retirement you will have good wealth creation. It doesn’t mean you just stop your investment.

If you are closer to retirement then you choose switching or moving your investment to hybrid investment then you can generate your income in average return with less chances of loss.

But you are at retirement age or month then revise your portfolio and opt conservative investment and save your capital with normal growth.

For planning retirement what you have to do,

- Analysed your financial need

- Investment need Diversification

- Calculate duration of investment

- Assessment your investment every three to five year

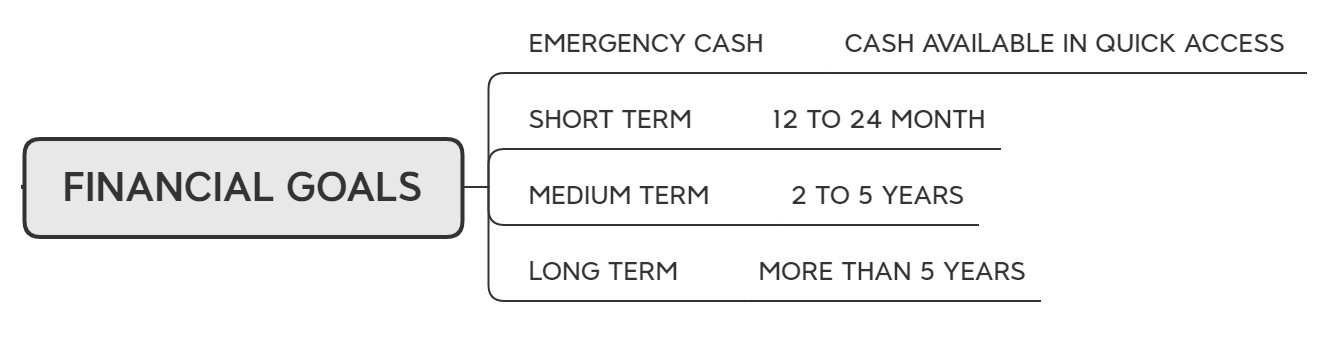

Financial goal

Financial goal you have to define before investment, every day is different and your requirement of need also.

While getting regular income from salary, generate a list of dreams and list increasing every year how to fulfil the dreams in a short time as well as one common financial goal like retirement.

First, you have to keep your emergency fund in the bank and invest in a banking tool you can access whenever you need.

Short term goals like domestic vacation, loan repayment, and your marriage will become debt free as early as possible within 12 month to 24 month.

Medium term goals may be to buy a car, buy a home for it, deposit down payment, and dream vacation or child education fees and many more which can be fulfilled within 2 to 5 years.

Long term goals means creating a retirement fund, child education for professional courses, daughter marriage, international travel or generating funds to start a business or services. There are so many goals you can plan for you with long-term invested in something more than 5 years.

In this article, you learn about the objective of investment and how to fulfil your goals throughout the life while getting regular income till retirement month. Saving and investment both are important because I discuss with you here different objectives with respect to their investment duration as well as talk about risk bear capacity and capability. You can choose any number of objectives not necessary but it will help you to plan for your own financial goal.

Now your mind may have some doubts about how to plan and achieve goals? I will explain to you in the next few articles.

I hope this article helps you !

If you have any questions?

Just ask or Leave a comment here…..

Recent Comments